FedNow® Instant Payments Services

TodayPayments.com is an all-in-one real-time payment platform built for modern businesses. We deliver full instant payments coverage through FedNow® and RTP®, along with smart reconciliation, AR tools, and dual-rail routing—so you never miss a beat, a payment, or a settlement window.

Our mission is to simplify and unify instant payments across the United States by empowering businesses with dual-rail real-time access to FedNow® and RTP®, while providing automation, transparency, and compliance every step of the way.

What Are Instant Payment Services? FedNow® and RTP® Explained

Instant Payments Are Here—And They Don’t Care What Rail You Use

Whether you're sending money through The FedNow® Service or the RTP® Network, one thing is clear: the era of instant payments is now.

For businesses, financial institutions, and fintech platforms, the distinctions between “real-time” and “instant” are blurring—because interoperability is closing the gap. The terminology might differ, but the outcome is the same: money moves instantly and settles in seconds.

At TodayPayments.com, we help you leverage both networks—FedNow® and RTP®—without worrying about what title your payment carries. Real-time is real-time. Let’s dive in.

Instant payment services allow funds to be transferred and settled between financial institutions within seconds, 24/7/365.

Here’s a quick breakdown:

- FedNow® Service: Operated by the U.S. Federal Reserve, FedNow® enables real-time gross settlement (RTGS) with immediate clearing, even on nights, weekends, and holidays.

- RTP® Network: Operated by The Clearing House, RTP® provides real-time payments with rich data messaging, ideal for invoicing, Request for Payment (RfP), and automated reconciliation.

Both systems:

- Are always on

- Support credit push transactions

- Allow for Request for Payment (RfP)

- Operate with ISO 20022 data standards

- Are designed for A2A, B2B, C2B, and P2P payments

The key takeaway? Whether it’s “instant” or “real-time,” speed, certainty, and transparency are built in.

FedNow® + RTP®: Interoperability in Action

Many businesses ask, “Which is

better—FedNow® or RTP®?”

But in reality, the future lies in

interoperability, not competition.

Payment processors like TodayPayments.com now offer dual-rail compatibility, meaning:

- You can send and receive payments through either FedNow® or RTP®

- You don’t need to choose one or the other—your platform handles both

- Your business gets maximum reach, uptime, and speed, regardless of rail

This means:

- Faster billing and collections

- Unified transaction history

- Better continuity for merchants and consumers

- Zero guesswork in payment routing

Your customers won't know—or care—what network you use. They’ll just see the funds, instantly.

Use Cases for Instant Payments with TodayPayments.com

Our real-time payment platform supports a range of use cases:

- Payroll disbursements in seconds

- Invoice settlements via RfP

- Instant refunds for eCommerce

- Subscription billing with recurring real-time debits

- High-risk merchant transactions with compliance and visibility

We integrate seamlessly with financial tools like QuickBooks®, and support file formats like .XML, .CSV, and .JSON. You can upload, batch, reconcile, and settle payments—all in real time.

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

Benefits and Features of Instant Payments Services Using FedNow and Real-Time Payments

Integrating FedNow Real-Time Payments with Instant Payments Services offers numerous benefits and features that significantly enhance the financial operations of businesses. Here is a detailed listing of these benefits and features:

Benefits

- Immediate Payment Settlement:

- Instant Access to Funds: Ensures businesses receive payments instantly, improving liquidity.

- 24/7/365 Availability: Operates round the clock, including weekends and holidays, allowing for continuous transaction processing.

- Enhanced Cash Flow:

- Reduced Days Sales Outstanding (DSO): Faster payments reduce the time it takes to receive funds, improving cash flow.

- Better Financial Planning: Immediate access to funds allows for more accurate and timely financial planning.

- Operational Efficiency:

- Automated Processes: Streamlines invoicing, payment processing, and reconciliation, reducing manual effort and errors.

- Time-Saving: Minimizes administrative workload, allowing businesses to focus on core activities.

- Payment Certainty:

- Real-Time Confirmation: Immediate confirmation of payments reduces uncertainty and enhances transaction transparency.

- Reduced Risk of Late Payments: Minimizes the risk of late payments or defaults, improving financial stability.

- Improved Customer and Vendor Relationships:

- Customer Satisfaction: Provides customers with a fast and convenient payment method, enhancing their experience.

- Vendor Trust: Ensures timely payments to vendors, potentially leading to better terms or discounts.

- Security and Compliance:

- Secure Transactions: Real-time payment verification reduces the risk of fraud.

- Regulatory Compliance: Ensures compliance with financial regulations and standards for secure payment processing.

Features

- Instant Transfers: Funds are transferred and settled instantly, providing immediate access to money.

- Continuous Operation: Transactions can be processed at any time, offering unparalleled flexibility.

- Automated Invoicing: Allows businesses to send automated payment requests to customers.

- Customizable Invoices: Invoices can be customized with business branding, payment details, due dates, and instructions for instant payments.

- Seamless Integration: Easily integrates with popular accounting software like QuickBooks Online (QBO) for automated updates and reconciliation.

- API Access: Provides API keys and credentials for smooth integration with financial systems.

- Payment Notifications:

- Real-Time Alerts: Immediate notifications for payment confirmations, ensuring businesses are always informed.

- Detailed Records: Maintains detailed transaction records for transparency and easy auditing.

- Automated Reconciliation:

- Automatic Recording: Payments are automatically recorded in the accounting system, updating financial records and reconciling transactions.

- Error Reduction: Minimizes manual entry errors, ensuring accurate financial reporting.

- Vendor Payment Scheduling:

- Timely Payments: Allows businesses to schedule and automate vendor payments, ensuring timely transactions.

- Cash Flow Management: Helps manage cash flow effectively by timing payments precisely.

Implementation Steps

1. Select a Payment Processor:

- Choose a payment processor or financial institution that supports FedNow and integrates with your accounting software.

- Install the necessary plugins or use APIs to integrate the payment processor with your accounting software (e.g., QBO).

3. Enable Instant Payment Services:

- Configure the settings in your accounting software to enable instant payment features.

- Set up invoice templates and vendor payment details for automated processing.

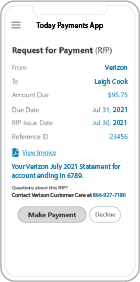

4. Manage and Send RfP Invoices:

- Create and send RfP invoices, providing customers with instructions for making instant payments via FedNow.

5. Receive and Reconcile Payments:

- Monitor payment confirmations and ensure payments are automatically recorded and reconciled in your accounting system.

Summary

Using FedNow and Real-Time Payments for instant payment services offers significant benefits and features that enhance the financial operations of businesses. By integrating these services with accounting software like QuickBooks Online, businesses can achieve immediate payment settlement, improved cash flow, operational efficiency, and enhanced security. The implementation of these services streamlines both accounts receivable and accounts payable processes, providing a seamless and efficient financial management solution.

Don’t Wait. Go Instant with FedNow® + RTP® via TodayPayments.com

Why limit your business to slow ACH or delayed wires?

✅ TodayPayments.com gives you full access to the FedNow® Service and the RTP® Network—with no silos, no delays, and no confusion.

✅ Accept and send instant payments, automate real-time reconciliation, and enjoy true dual-rail interoperability under one unified system.

✅ Whether you need B2B, C2B, or A2A payments—we make real-time easy.

💡 Stop asking which rail is

better.

👉 Visit

https://www.TodayPayments.com and get real-time payment

power with zero compromise.

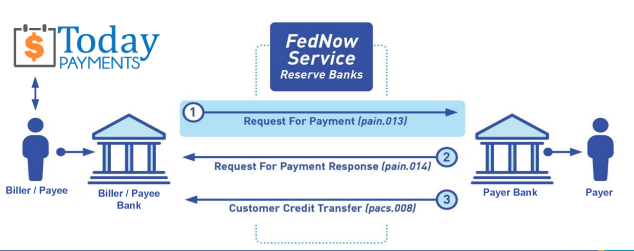

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Instant Payments Services system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing